How To Form 10e PDF Annotator Online?

Easy-to-use PDF software

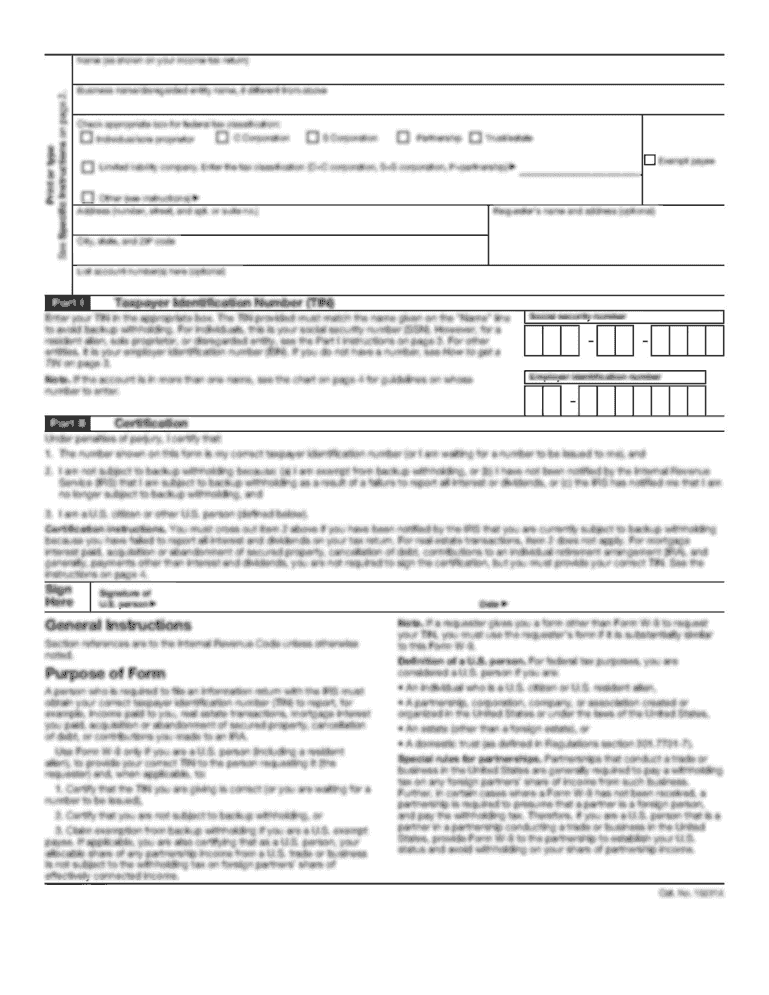

What is Form 10e?

All registered users, being an Individual, on the e-Filing portal can furnish particulars of their income in Form 10E for claiming relief as per Section 89 of Income Tax Act, 1961.

How to start PDF Annotator for Form 10e

Looking for a PDF Annotator for Form 10e? You’re about to find it. Forget about printing and scanning for sure and save time with our web-based service. The solution offers you all the tools you need to create, fill out and submit a form in clicks. Plus, you don't need to install anything else; the platform is available for mobile and laptop through any browser. Read the brief guide below to learn how to get started with PDF Annotator for Form 10e:

- Visit our website and open the form with an editor.

- Select a tool from the menu to add text, images, checkboxes, stickers.

- From the side menu, drag and drop fillable fields for text, signatures, date, numbers, etc.

- The Reorder Pages option allows you to rotate, rearrange and duplicate pages in the pop-up window.

- Make the document enforceable by signing it with the Sign tool.

- Click the orange Done button to save the edits you've made.

Work with documents simply from any device using our platform. The service is comprehensive yet user-friendly so that you can handle any PDF-related problem easily and level up your document management in general.

Benefits of trying our PDF Annotator for Form 10e

There're a lot of solutions on the market that help you work on a document. So choosing an ideal app can be challenging, especially if you don't have time for comparing different alternatives. Check out our service in clicks and enjoy a superior user experience. Our intuitive interface lets you start running the service hassle-free without a time-consuming learning curve. Cope with documents easily and forget about burdensome tasks once and for all. Get to know the best benefits of PDF Annotator for Form 10e:

- Secure workflow

- Regular access to data

- Advanced editor

- Web-based solution

- User-friendly interface

Available from any device:

- Smartphone or iPhone

- Tablet or iPad

- Laptop or PC

Need a template of Form 10e?